Who pays Capital Gains Tax?

Here are three capital gains tax (CGT) questions for you to ponder:

1. How many individuals made enough capital gains in 2018/19 to face a CGT bill?

According to the latest provisional figures from HMRC, the answer is just 256,000. This is 9,000 fewer than in the previous tax year. Viewed another way, that amounts to less than 1% of all income taxpayers. However, over the 10 years since 2008/09, the number of CGT payers has nearly doubled.

So now you know that individual CGT payers totalled about a quarter of a million, try the next question…

2. How much tax did they have to pay in total?

The answer is £8,805m, which is over £3,400m more than was collected in inheritance tax (IHT) in 2018/19. IHT and CGT are both capital taxes, often charged on the same asset, although usually at different times. But CGT attracts much less criticism than IHT, which has been rated as the UK’s most-hated tax.

With the information on how many taxpayers and how much tax was collected, the third question might look easy…

3. What proportion of that £8,805m was paid by the top 5,000 CGT payers?

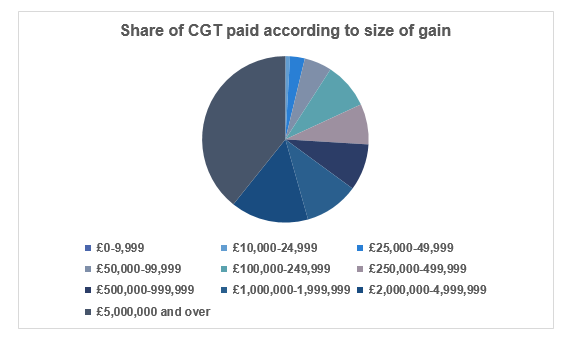

The top 5,000 – about 2% of all CGT payers – contributed 54.4% (£4,789m) of the total CGT paid. They all had gains of at least £2,000,000. Expand the band a little and 18,000 individuals, with gains of at least £500,000, accounted for just under three quarters of the CGT paid. The spread of gains and tax paid is shown in more detail in the pie chart below.

The answers to these three questions highlight two points which give pause for thought, one for the Chancellor and the other for you as an investor:

- As with some other personal taxes, the amount raised from a small number of the wealthiest individuals is a significant proportion of the total. This means that the results of increasing the tax rate(s) will heavily depend upon how those individuals react. If some of them decide not to realise their gains, the overall takings from this tax could fall rather than rise.

- The annual CGT exemption is £12,300 in 2020/21. Investment returns that are received as capital gains are usually taxed more lightly than those received as income. The relatively small number of taxpayers is a reminder of the current generosity of the exemption.

The value of tax reliefs depends on your individual circumstances. Tax laws can change.

The Financial Conduct Authority does not regulate tax advice.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.